federal income tax calculator

Updated 2022-06-14T204352Z A bookmark. The lowest tax bracket or the lowest income level is 0 to 9950.

Federal Income Tax Calculator How To Estimate Your Taxes

This calculator computes federal income taxes state income taxes social security taxes medicare taxes self-employment tax capital gains tax and the net investment tax.

. It is taxed at 10 which means the first 9950 of the money you made that year is taxed at 10. To lower the amount you owe the simplest way is to adjust your tax withholdings on your W-4. Federal income tax calculator.

This tax calculator is solely an estimation tool and should only be used to estimate your tax liability or refund. Use this federal income tax calculator to estimate your federal tax bill and look further at the changes in 2021 to the federal income tax brackets and rates. Our W-4 Calculator can help you determine how to update your W-4 to get your desired tax.

Median household income in 2020 was 67340. Using the brackets above you can calculate the tax for a single person with a taxable income of 41049. See how your refund take-home pay or tax due are affected by withholding amount.

Federal income tax rates range from 10 up to a top marginal rate of 37. Estimate your federal income tax withholding. The Tax Calculator uses tax information from the tax year 2022 to show you take-home pay.

Estimate your 2021 refund or how much you owe the IRS in a few easy steps. The next 30575 is taxed. Calculate your state local and federal taxes with our free payroll income tax calculator simply choose your state and you are all set.

Federal Paycheck Quick Facts. The first 9950 is taxed at 10 995. Use this tool to.

Based on your annual taxable income and filing status your tax bracket. See where that hard-earned money goes - with Federal Income Tax Social Security and other. Use our Tax Bracket Calculator to answer what tax bracket am I in for your 2021-2022 federal income taxes.

How It Works. The next six levels are. Use this calculator to estimate the amount of money that would be withheld from your monthly pension payments for federal income tax based on the IRS current tax tables and.

How To Calculate 2019 Federal Income Withhold Manually

Github Pslmodels Tax Calculator Usa Federal Individual Income And Payroll Tax Microsimulation Model

Us Tax Calculator Shop Save 50 Laboratoriofurlan Com Br

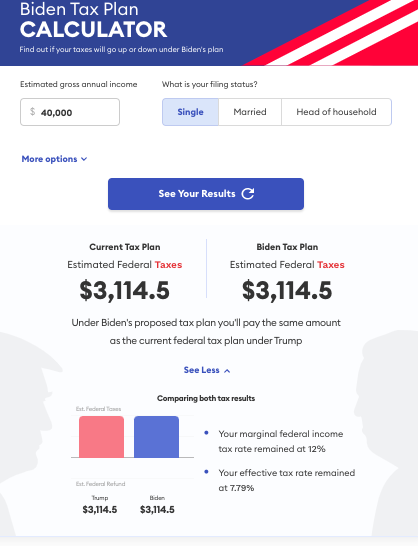

Interactive Pres Biden S Federal Income Tax Plan Proposal Blog

How To Calculate 2020 Federal Income Withhold Manually With 2019 And Earlier W4 Form

Federal Tax Calculator 2019 Clearance 57 Off Oldetownecutlery Com

80 000 Income Tax Calculator New York Salary After Taxes Income Tax Payroll Taxes Federal Income Tax

Yearly Federal Tax Calculator 2022 23 2022 Tax Refund Calculator

2022 Income Tax Withholding Tables Changes Examples

How To Calculate Payroll And Income Tax Deductions Peo Human Resources Blog

Solved Rogramming Assignment The Us Federal Personal Income Chegg Com

2022 Federal Income Tax Estimator Tax Spreadsheets Tax Etsy

Federal Income Tax Fit Payroll Tax Calculation Youtube

How To Calculate Federal Income Tax 11 Steps With Pictures

California Tax Expenditure Proposals Income Tax Introduction

Federal Income Tax Form 1040 Excel Spreadsheet Income Tax Calculator

2021 2022 Federal Income Tax Brackets Tax Rates Nerdwallet

Federal Tax Calculator 2019 Clearance 57 Off Oldetownecutlery Com