iowa property tax calculator

Iowa Real Estate Transfer Tax Calculator Enter the total amount paid. Iowas property taxes are determined on a per-county basis.

Orange City S Total Property Tax Levy Rate Ranks 551st In The State Orange City

Property values in Iowa are assessed every two years.

. The assessor or the Iowa Department of Revenue estimates the value of each property. Annual property tax amount. This reduction in the amount of credits and exemptions will occur when the amount of funding.

1 Look Up County Property Records by Address 2 Get Owner Taxes Deeds Title. The assessed value of the property and the total local tax rate. The median household income is 58570 2017.

Iowa has a population of over 3 million 2019 and is the leading producer of corn in the world second to China. This calculation is based on 160 per thousand and the first 50000 is exempt. This calculator can only.

The Dallas County Assessor determines property values and provides notification to property owners. Total Amount Paid Rounded Up to. Iowa Tax Proration Calculator Todays date.

Please contact the Assessors Office for the latest valuation information on. Our Iowa Property Tax Calculator can estimate your property taxes based on similar properties and show you how your property tax burden compares to the average property tax on similar. Ad Find Out the Market Value of Any Property and Past Sale Prices.

Uh oh please fix a few things before moving on. The median property tax in Iowa is 156900 per year for a home worth the median value of 12200000. If you know the amount of Transfer Tax Paid and want to determine the.

This mortgage calculator will help you estimate the costs of your mortgage loan. Annual property tax amount. Your average tax rate is 1198 and your marginal tax rate is 22.

This is a tax rate that is assessed annually based on the value of real property. Fields notated with are required. This Calculation is based on 160 per thousand and the first 500 is exempt.

Iowa Real Estate Transfer Tax Calculator Transfer Tax 711991 thru the Present. Tax amount varies by county. Property Tax Calculator Type your numeric value in the appropriate boxes then click anywhere outside that box for the Annual Gross Total to appear.

January 1 2020 Assessed Value. Iowa Tax Proration Calculator. Iowa Income Tax Calculator 2021.

Please select a county to continue. To use our Iowa Salary Tax Calculator all you have to do is enter the necessary details and click on the Calculate button. This calculation is based on 160 per thousand and the first 500 is exempt.

The value of property is established. Get a clear breakdown of your potential mortgage payments with taxes and insurance included. 4 Reduces Taxable Value by 4850 pursuant to Iowa Code Section 4251.

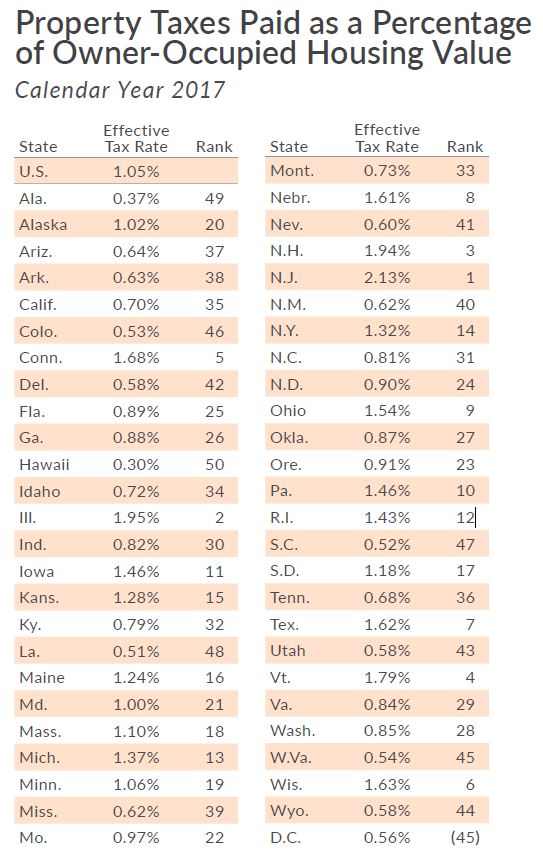

Additional withholding cannot exceed your taxable wages less your federal withholding for a pay period. Counties in Iowa collect an average of 129 of a. This is called the assessed value The assessed value is.

Iowa state income tax. The median property tax on a 13680000 house is 143640 in the United States. The median property tax on a 13680000 house is 176472 in Iowa.

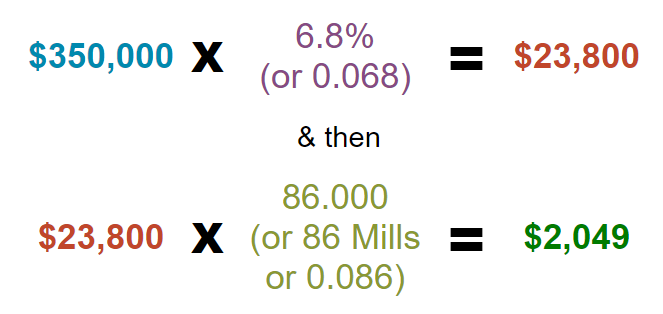

Taxes are based on two factors. The first half or 500 of the previous years taxes was paid in September and the second 500 will assumingly be paid on. You may calculate real estate transfer tax by entering the total amount paid for the property.

Example 1 - 1000 property taxes with a closing date of February 1. If you make 70000 a year living in the region of Iowa USA you will be taxed 14177. Enter amount paid in the box below exclude commas and dollar signs then click submit.

If you would like to update your Iowa withholding. After a few seconds you will be provided with a full breakdown of the. However the average property tax is 129.

How are property taxes calculated in Iowa.

Property Tax Prorations Case Escrow

2022 Property Taxes By State Report Propertyshark

Rent Vs Buy Calculator Is It Better To Rent Or Buy Smartasset Com Retirement Calculator Financial Advisors Property Tax

How To Calculate Property Tax Everything You Need To Know New Venture Escrow

Property Tax Calculation Boulder County

North Central Illinois Economic Development Corporation Property Taxes

Top Income Tax Rate By State States With No Income Tax 1 Alaska 2 Florida 3 Nevada 4 South Dakota 5 T Retirement Retirement Income Retirement Locations

How To Calculate Property Tax Everything You Need To Know New Venture Escrow

Property Tax Calculator Casaplorer

How Do Iowa S Property Taxes Compare Iowans For Tax Relief

Pin By Julissa Alvarez On Irs Taxes Calculator Casio Cool Desktop

Monday Map State Local Property Tax Collections Per Capita Property Tax Teaching Government Map

Notice From The City Of Oskaloosa City Social Media Pages Previous Year

Notice From The City Of Oskaloosa City Social Media Pages Previous Year

Property Tax Calculation Boulder County

This Map Shows How Taxes Differ By State Gas Tax Healthcare Costs Better Healthcare

Taxprof Blog In 2022 Infographic Map Real Estate Infographic Map